Kris Currie had a dream of going off-grid, so he designed an energy-creating home so that he wouldn’t have to pay tax on his energy bills, but in the end, he has had to do exactly that.

His complex is built in New Dominion, P.E.I. (Prince Edward Island), Canada and every aspect of it was designed to create energy. Currie planned to not pay any money to the government for the energy he managed to make all by himself.

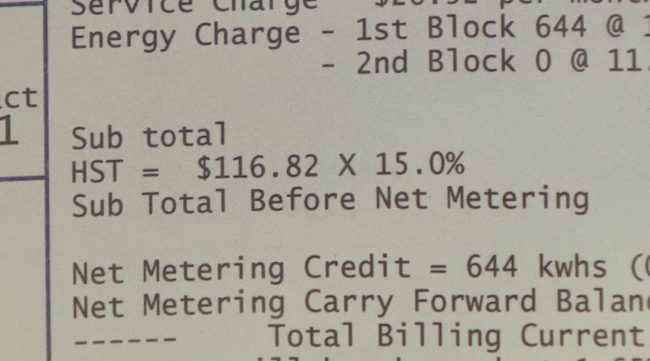

Yet, when he received a bill for tax on every kilowatt produced per hour in his home, he was shocked!

He spent $46,000 on building his own solar paneled house, including $6,000 HST on materials like extra insulation and solar panels, believing that it would allow him to avoid this kind of tax, but sadly, he was wrong, as the HST (harmonized sales tax) still charged him.

Despite paying zero for his energy bills to Maritime Electric, he is still billed for the HST on every kilowatt-hour used, just like any other customer.

His home has 35 solar panels which are meant to generate all the electricity needed to power the home for a year. While heating oil is exempt from HST on P.E.I., other energy sources for heating like wood — or electricity — are not.

Currie is part of P.E.I.’s net metering program, which allows individual homeowners to generate their own electricity, sending any excess into the grid in exchange for credits so they don’t have to pay when they draw electricity back out of the grid — for instance when solar power can’t be generated at night.

Kris said that he finds this nonsense, as they are using it for heat, for one. “Oil’s exempt. Now that we’re producing the electricity we’re getting charged for it.”

He adds that he built his net-zero home without government assistance, and in fact, he paid HST on the solar panels and the labor to have them installed. He did this partly to save on his monthly bills, but also to reduce his family’s carbon footprint.

The bizarre set up is believed to be another one of the government’s schemes to dissuade people from living off-grid.

CBC has reported that his home is generating more electricity than it uses, feeding the excess into P.E.I.’s electricity grid, where it’s sold to other Maritime Electric customers, who pay HST on what they use.

The added tax means it will take longer for Currie to pay off his investment, and he maintains that will discourage other homeowners from doing the same thing, as everybody is on a cost basis when they go to build a house or retrofit a house or try and reduce their energy consumption.

He added:

“It all goes into cost at the end of the day, how many years payback will you get? …The quicker we can get a payback, the quicker this stuff’s going to get produced.”

After his campaign to remove the sales tax charged to Canadians who produce their own solar electricity and bank it with a local utility through a net metering program, he did receive some relief from the P.E.I. government, as the province removed the provincial portion of the HST from part of all residential electric bills. That move has cut the tax Currie pays on his electric bill roughly in half.

As his story went viral, Currie stated that Canadians all across the country have reached out to him to ask about creating their own net-zero homes.

P.E.I.’s executive director of climate change and environment Todd Dupuis stated that the province would introduce new incentives for solar energy in 2019, but didn’t provide details.

The province told CBC it had asked the Canada Revenue Agency for a ruling on the taxation of energy produced under its net metering program, and it supported what the federal finance minister told P.E.I. Senator Percy Downe, who took the issue up and asked for a review of the situation with the P.E.I. government.

Namely, the ruling confirmed that electricity is a taxable supply, so Maritime Electric is required to charge HST on the full value of that supply, even if the customer is being credited for the electricity itself.

If you know someone who might like this, please click “Share”!